Why are terrible stocks rising?

.png)

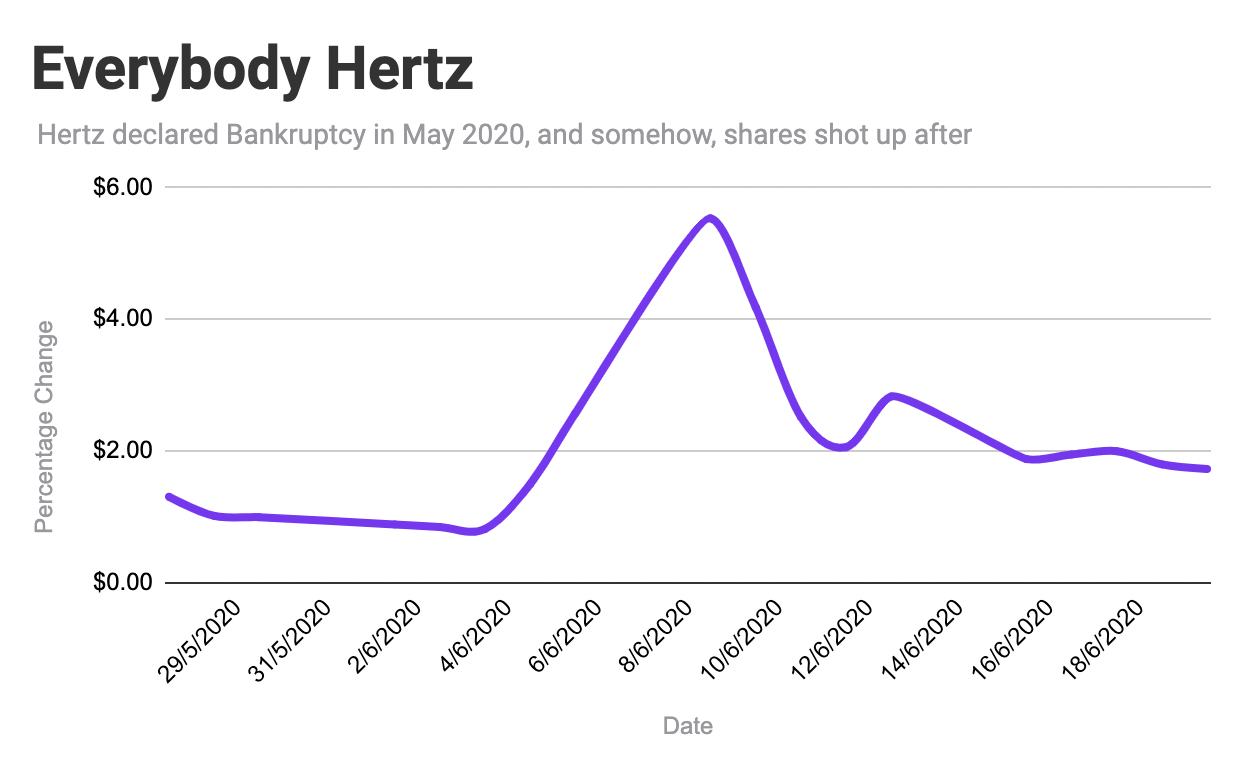

In June 2020, something very weird happened. Hertz, the car rental company, had announced it was filing for bankruptcy the month before. That part wasn’t weird — after all, a global pandemic had just shut down the whole economy overnight, and people were not renting cars, or traveling at all. Hertz, who had already been in financial trouble for a while, couldn’t survive a hit like that. After the bankruptcy was announced, shares plummeted to below a dollar a share, making it a literal penny stock.

Then, a few weeks later, shares started rising. Not just a little — they rose over 900%. Had Hertz discovered a secret stash of money? Nope, the company was still very bankrupt. Instead, investors were pumping the stock up. This lasted for a while, and Hertz even tried to sell its own shares at the high price to maybe get it out of bankruptcy, but that plan fell through.

This story, while amusing, should sound familiar to anyone that’s spent any time reading about stocks like Gamestop, Tesla, or even Dogecoin, the cryptocurrency that was literally started as a joke and somehow has been climbing to record heights after getting public support from Tesla CEO Elon Musk.

So what gives? Why are companies or assets that are doing badly financially or even bankrupt suddenly rising? And does that mean you should start betting on bankrupt companies?

What’s a share worth?

At the root of this whole topic is a very simple question — what are shares of a company worth? Financial analysts build incredibly complex models to answer this question. They plug in every number the company publicly reports in its earnings report, try to squeeze out some more detail from the executives, and come up with an estimate for how much money the company will make in the next 12 months or even longer. All that information then goes into a formula that spits out a share price.

But shares are not bound to that logic. On exchanges, shares are simply bought and sold, and depending on how much supply and demand there is on either side, the price goes up and down. Sure, most investors try to buy a share they think has the potential to go up, because the company is doing well, and sell when they think it won’t go up anymore. But in essence, shares are worth whatever people are willing to pay for them.

So let’s do a little thought experiment. Imagine that one day, a million investors decide they’ll buy the shares of a random company, no matter how bad or good it is. The incredible demand for shares would pump the price up. Now, the conventional thinking dictates that at some point the price goes up so high that investors stop buying and start selling, in order to cash their profits. It’s like inflating a balloon and trying to stop just before it pops.

But what if the investors … didn’t stop? What if they were bound together by some different motivation, and decided they don’t care about profits, but just want to keep inflating the share price? Theoretically, nothing could really stop them. And that’s basically what happened to Gamestop, with a few minor differences.

The rise of the retail investor

There’s one good reason why you’re seeing more of this happen now. In the past few years, trading apps have unlocked trading for an audience that used to be shut out. Gone are the days where you have to be a respectable middle-aged white guy in a suit with a human broker to invest. If you have a smartphone and a few spare euros, you can invest just as easy as anyone.

The sudden influx of so many people who don’t know a lot about the old rules of investing is changing the game. Together, these new investors wield a lot of capital — a few euros multiplied by millions of people adds up — and they don’t care what the analysts say.

Does that mean you should invest in bankrupt companies? Absolutely not. A bankrupt company is still a bankrupt company, and though there’s always a chance that you could ride the wave up, there’s an even bigger chance you’ll be riding the wave down. You could make $1,000, but you could just as easily lose $1,000.

That being said, the rules are changing, and the old system of figuring out when a stock has hit its top is not as good at predicting as it used to be. Some companies like Tesla, whose stock price makes the company bigger than carmakers that sell more than 10 times the cars it does, might keep their inflated valuations for a while.

So what happened to Hertz in the end? For one, the company is still bankrupt. Shareholders, who are last in line for any sort of compensation once the company finishes its bankruptcy proceeding, will be left with very little. As of this writing, the shares are worth about $1.60 — still higher than the price it had after it declared bankruptcy, but a far cry from the value it had for a short bright moment in June 2020.

Any opinions, news, research, analyses, or other information contained on this website are provided as general market commentary, and do not constitute investment advice, recommendations nor should be perceived as (independent) investment research. The author or authors are employed by Vivid and may be privately invested in one or several securities mentioned in an article. Vivid Invest GmbH offers as a tied agent of CM-Equity AG the brokerage of transactions on the purchase and sale of financial instruments with the exception of those in the area of foreign exchange brokered by Vivid Money GmbH.